The bank or creditor doesn’t want to see you walk away for your debt, especially if you have a reasonable hardship.Ī hardship letter is a summary of what happened that caused the current situation, what the homeowner has done to correct it, and what the homeowner hopes to accomplish with the lender’s or creditor’s help.Ī hardship is not based solely on financial matters. Other uses of a hardship letter include: requesting relief for being behind on your mortgage or credit card requesting a reduction in education fees (college, university, private school, etc.) or requesting a reduction in hospital bills or insurance costs because of an unexpected, unusual medical procedure or treatment. For these, the letter explains why the homeowner is making a request for a loan modification or needs to short sale the property. The third party will attempt to contact you via phone, SMS and letter.In most cases, a hardship letter is written as part of the paperwork to conduct short sale or loan modification.

You’ll be contacted by the third party and you’ll need to work with them for repayment of the debt. We’ll advise you once your debt has been sold. This usually occurs once you’ve missed six months of your contractual repayments. If you haven’t been able to repay your credit card or personal loan, we may sell your debt to a third party. Sale of your credit card or personal loan

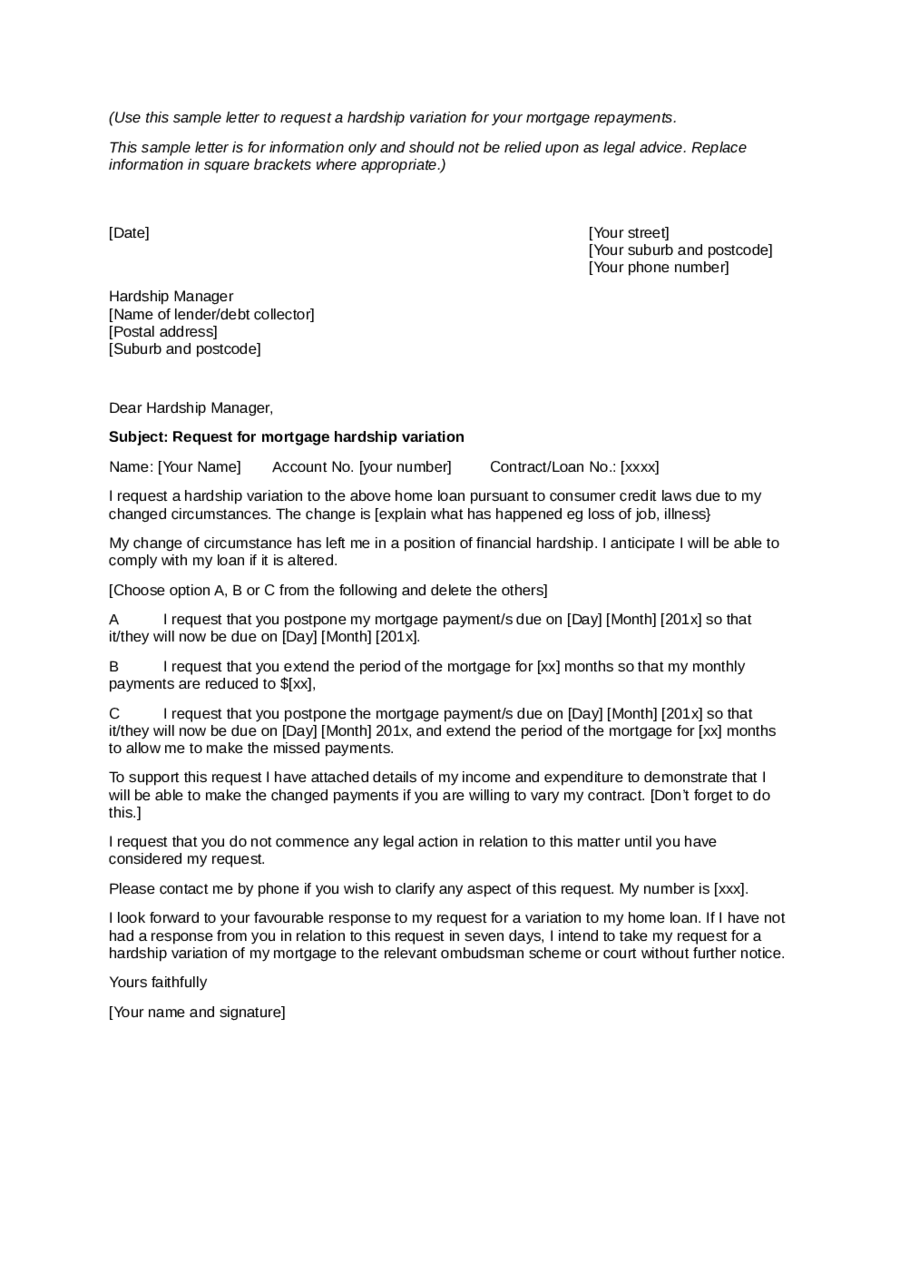

SAMPLE LETTER FOR HARDSHIP CREDIT DEBT FULL

Once you’ve received the demand notice you’ll need to tell us how you plan to pay the full debt. We’ll usually issue a demand notice if we haven’t reached an agreement to repay the overdue amounts that works for both you and us. If you can’t fix the default shown in the default notice, we or a third party acting on our behalf, will send you a demand notice that requires you to repay the entire credit card or personal loan balance. We’ll usually only refer your account if you aren’t working with us or have an arrangement in place to bring your account up to date. We may refer the collection of your credit card or personal loan to a trusted third party who will contact you on our behalf.

It's your responsibility to pay what is outstanding or let us know if you need more time. We’ll usually only issue a default notice if you have missed some scheduled repayments and you aren’t already working with us to find a solution. For example, if the default is that you’ve missed repayments, we will give you at least 30 days to catch up on your repayments. Default noticeĪ default notice will tell you how you are in default of your credit card or personal loan and how you need to fix it. The steps below outline the debt recovery process. You can also talk to a financial counsellor for free. If you’re unsure at any time during this process, you should seek legal or financial advice. This is a last resort only and will only occur after every possible option is explored. You can appeal for a loan modification or request an alternative payment arrangement subject to the creditor’s approval. In the letter, you can politely request an alternative way of settling the debt.

The debt collection process will begin if we can’t get in contact with you or if we haven’t made a payment arrangement. A debt hardship letter is a letter you will have to send a current creditor explaining your financial situation.

0 kommentar(er)

0 kommentar(er)